Workday Compensation Grids and Profiles

Compensation grids and grid profiles are tools used to assign workers to different compensation ranges. A Workday compensation grid is a guideline for determining pay ranges, while great profiles allow for the assignment of workers to different ranges based on localization requirements.

Great profiles are optional and can be set up as zero in the grid.

Assigning the compensation grid to workers can be done directly to the job profile or using eligibility rules. Large organizations with 300,000 employees can use this approach, but smaller Workday organizations can also manage it.

Creating a compensation grid is a task that can be maintained and changed as needed. The grid should be created as a reference and can be maintained through various methods, such as creating grade profiles or updating the grid.

It is important to consider the specific needs and requirements of each Workday organization when creating and managing compensation grids.

Using Edit Comp Grid for Managerial Compensation: US and UK Perspectives

Coming to the use of an edit comp grid for creating compensation grids. The grid hierarchy is not crucial, but the edit comp grid is used.

Two great profiles are defined, one for managers or above in the USA and the other for the hierarchy level or seniority level. The base page element is set to be the base page.

The name of the profile can be specified as M1, which is acceptable in the US. The base pay component includes mandatory eligibility rules.

Then moving on to assigning compensation grades directly to the job profile without using eligibility rules.

The subject also touches on the use of asterisks in the eligibility rules, which are not mandatory but are mandatory for the grade.

The focus ends with the discussion of the two sets of eligibility rules, one at the top and one at the grade profile level.

The compensation grade is not required to have an eligibility rule, as it is directly assigned to the job profile. The grade profile is used to identify the pay range for US or UK managers. To select the subpopulation of workers, an eligibility rule is defined based on criteria.

The localization rule is used to ensure the range is only for managers or above in the US. The currency is US dollars and the frequency is annual. The minimum and maximum range is set at 50,000 to $80,000, with four segments (1, 2, and 3) for the compensation grade.

The midpoint can be defined based on statistics or by using the calculate segment checkbox. Workday divides the range into four equal parts, like 30,000 divided by 47,500. This ensures that the compensation grade profile is only for managers or above in the US.

The concept of assigning a compensation grade to managers or above in job profiles, ensuring that it is only applicable to managers or above in the US. This will help in making informed decisions and understanding employee pay.

The possibility of different pay ranges for managers in different departments, such as IT or Workday HR. To address this Workday issue, it is suggestable creating an eligibility Workday tool based on the supervisor Workday organization, ensuring that all criteria are met for a profile to be selected.

With the possibility of creating profiles with different eligibility rules, such as for UK managers or above. The Workday also mentions the possibility of using multiple eligibility rules, such as for UK managers, to ensure that all criteria are met.

Defining Eligibility Rules in Workday Project and Workday implementation

The eligibility rule is a high-level decision made at the Workday implementation stage of the Workday project, with the compensation team brainstorming on how to define eligibility rules, pay employees, and streamline the process.

Crucial Compensation Rules for Businesses: Design and Discussion with Analysts and Administrators

Compensation rules are crucial for businesses, as they impact hundreds and thousands of employees. They must be designed in detail and discussed in detail with compensation administrators and administrators from different countries.

For example, a customer had a compensation structure for 20 countries, but after acquiring a new Workday company, they had to create new eligibility rules for 25 countries.

This was a nightmare, as each Workday company had its own rules. Business analysts are responsible for discussing the rules with compensation specialists and administrators, determining their location, job profile, department, and other factors that may affect workers’ compensation.

Workday Payroll: The Essential Workday Integration for Employee Compensation Management

Payroll is the most critical aspect of Workday work, as it directly impacts hundreds and thousands of employees.

If payroll is wrong, it can have a huge financial impact. As a Workday integration Workday consultant, payroll is the most critical of integrations, as it must run correctly and successfully.

Payroll is essential Workday for employees to be paid on time and accurately every day, and compensation is a crucial input to Workday payroll.

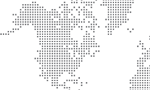

Allowance plans (Unit-Based Car Allowance Plans: An Overview)

The concept of allowance plans, which are defined in units of a product rather than money. There are three types of allowance plans: amount-based, percentage-based, and unit-based.

The amount-based plan is straightforward and has an upfront amount.

The percentage-based plan is a percentage of something, such as a house rent allowance, which is typically 50% of the base.

The unit-based plan defines the unit of something, such as gas.

The Workday payroll team can define the unit of something, such as 20 gallons of gas per month. The compensation element is mandatory, but the frequency should be specified. The default amount for car allowances is zero, but the compensation element is mandatory.

The frequency can be annual, monthly, hourly, or daily. The document also discusses the concept of FTE percentages and how they can be applied to the allowance plan.

Overall, the text emphasizes the importance of understanding and managing allowance plans to ensure fair compensation and flexibility.

The article discusses the merit eligibility process for car allowances, focusing on fixed amounts for part-time workers. It also discusses allowance plan profiles, which allow for defining the range of compensation grade profiles, except for localization.

discussing the flexibility of using multiple eligibility rules or conditions in one eligibility rule. The Tutorial explains that the UK has a specific eligibility rule for US employees, while the US receives $1200 a month.

The Workday tutorial also mentions the ability to add departments or conditions to the eligibility rules. The material also discusses planned eligibility, which specifies the amount to be paid for a specific employee based on their location. The Workday tutorial also discusses the flexibility of using multiple conditions in one eligibility criteria.

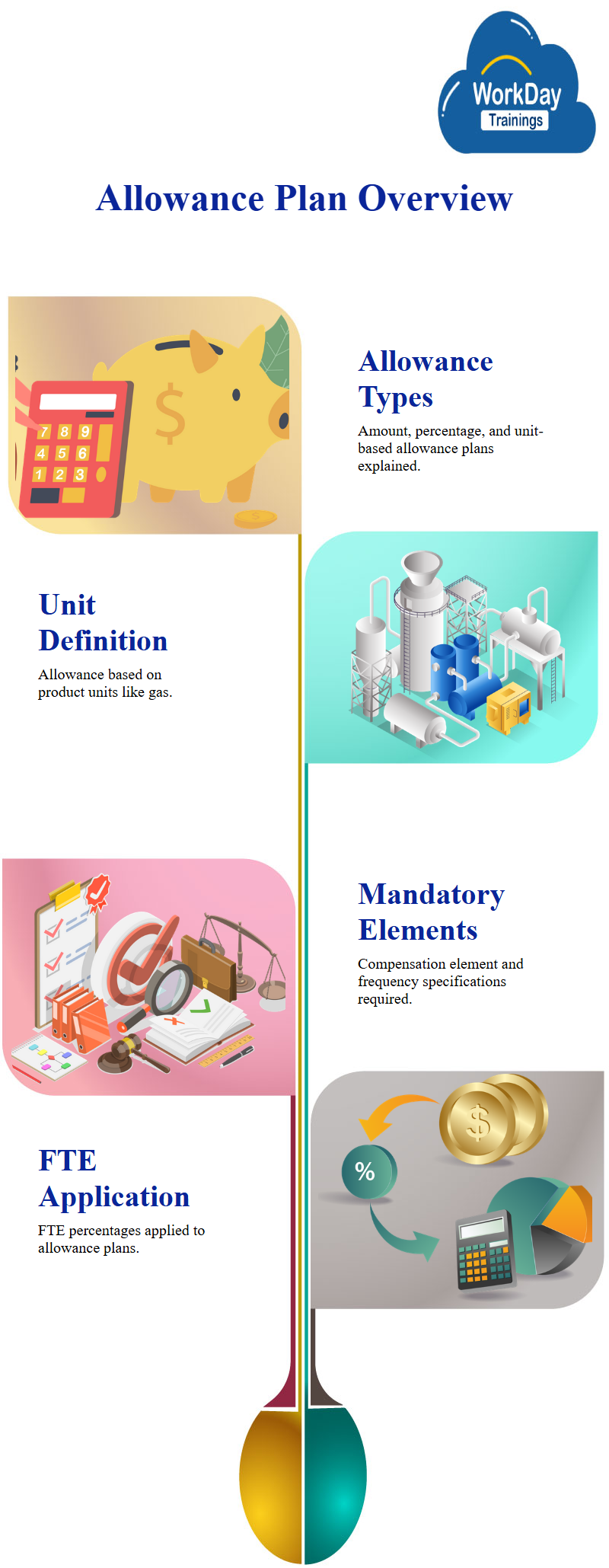

By this, we can draw the conclusion that the Workday manual mentions the difference between the eligibility rules in the plan profile and the merit eligibility rules and also between eligibility rules and compensation grid profiles.

The first rule, plan eligibility, specifies who should receive a car allowance, while the second rule, compensation eligibility, assigns the allowance to the worker based on their location.

The importance of eligibility is highlighted, as without it, the employee will not receive the allowance. The amount of the allowance depends on the plan profile, and if it doesn’t meet the eligibility criteria, the default amount is given.

This also discusses the need for an eligibility rule in the system, which can be created using a comp eligibility rule.

The source external field or condition rule should be based on the management level, and the compensation level should be the management level.

The material concludes by highlighting the importance of using eligibility rules in compensation systems.

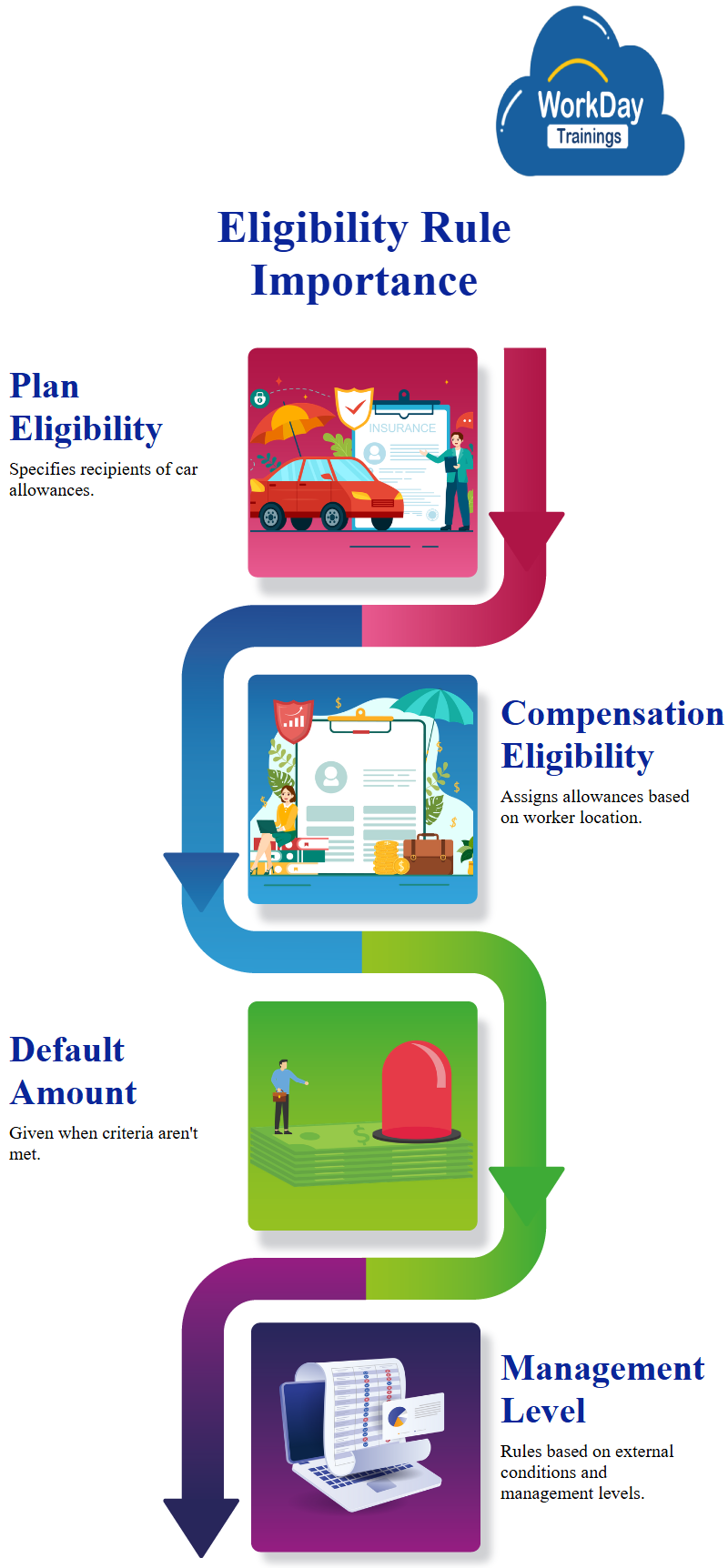

Global Compensation Package for Managers and Non-Managers

The creation of a compensation package Workday for employees in the United States and the United Kingdom. The package includes a base pay for non-managers and a salary plan for managers or above.

The eligibility rules are the same, with base pay in the United States and a bounce in the UK. The package includes guidelines and plans, with the salary plan and car allowance being included in the allowance plan.

The package is effective from March 24th and will be named “www compensation package.” The package includes both managers and non-managers, with the salary plan and car allowance included in the allowance plan.

Understanding Compensation Eligibility in Workday

The system allows for a base pay amount that is less than or greater than the grade range for which the employee was eligible.

If an employee is eligible for three allowance plans but not in their package, they will not receive the money or payment.

Focusing on the eligibility of an employee for a compensation component during staffing events. The employee is already in the same location, so they are not eligible for the relocation allowance. The recruiter or compensation partner may not assign the component as part of their package. The employee is then asked to determine if they are eligible for the allowance.

Then moving on to the grouping of compensation plans and grades, which determines an employee’s eligibility for a component during staffing events.

The component for which an employee is paid and for what purpose is a compensation plan. The grade is a guideline, and the element and localization are the grade profile. Coming to end we can understand the discussion of the eligibility rule, the component for which an employee is paid, and the localization of the grade profile.

Harsha

New Technology, let's explore together!