Workday Finance Course

Unlock the Potential of Your Finances with Workday Finance Course!”

Hello People.

In a world of constant change, it is easy to get lost. But with a bit of imagination, anything is possible.

Take a step into my world and let your mind wander. Discover new technologies, meet new offers, and explore the possibilities.

Here is no boundary to what you can find, so let your curiosity guide you. Welcome to my world of exploring new technologies.

Today, let’s talk about Financial Management…In a rapidly developing world, having a solid handle on your finances is more important than ever. The finance workday is at the forefront of helping people stay on top of their money. Workday Finance Technology has the tools and resources to keep your finances in order, from tracking spending to budgeting for the future.

What is Workday Finance?

It helps streamline the finance process and keep track of everything going on. It is a complete system that the companies and their employees use. In this process, all the information that is related to purchasing, paying, and reporting is managed by it. It is also an ERP software used for HR and financial management.

The primary purpose of using this software is to manage a company’s complete finance process. It is a cloud-based app that can be used from around the world. Companies are using this software to manage the whole work process.

Workday Finance is a cloud-based application that can be customized to the needs of the enterprise. It provides an integrated platform that offers real-time visibility into the business. It also enables financial to take action Workday technology can also be used to connect with customers and suppliers from anywhere. It also allows you to make better decisions that can help you with change and growth.

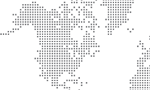

What are the Benefits of Workday Finance?

Workday Finance shows the entire business in a single system, including resources, revenue, and expense transactions and balances.

With Workday Finance, you can Manage the entire Financial Management process from beginning to end, including budgeting, reporting, and consolidation.

Take action on real-time insights across the entire business. Workday Financial Management is the only solution that provides a unified platform for Financial Management and Human Capital Management HCM.

Workday Financial Management enables you to take control of your operational and financial processes, give your leaders the insight they need, and make better decisions.

Workday Financial Management helps you Create an accurate and auditable historical record of your business transactions.

Plan for the future and take action on real-time insights. Organizations use Workday Financials Training to Gain insights into business performance.

How is this Workday Finance Functional?

The entire team of Finance and accounting can use the workday finance system application. It helps them to gain a complete picture of the whole business.

It helps the finance and accounting team to manage and control the entire financial process. It helps eliminate errors in financial transactions.

Workday for finance allows the team to spend less on manual tasks and more on critical activities. It also helps in reducing costs and in strengthening the business.

The workday application provides a complete financial solution to organizations. It helps manage the entire financing process from the smallest to the most significant business.

It helps in catering to the needs of every business. It helps in making the best use of financial resources. It helps in making the business successful.

Workday finance is the complete package of finance and accounting applications. It has many applications that help businesses survive in this competitive world.

How will this Workday Finance help me in my Career?

This Workday Finance Training will help you in your career by teaching you how to manage your finances and save money.

How will a finance training course benefit your career? After all, Finance is all about numbers and calculations. While this is true, Finance is also about understanding how businesses operate and make money. This is where your finance training comes in.

By understanding the basics of Finance, you’ll be better equipped to make decisions that affect your career. For example, if you’re ever in a position to negotiate your salary, you’ll know how to ask for what you’re worth. Or, if you’re considering switching careers, you’ll be able to evaluate different options to see which one is the most financially viable.

But finance training isn’t just about making more money. It’s also about being a good steward of the money you have. You can brand your cash work and achieve financial freedom with proper financial management. After all, what’s the point of earning a high salary if you’re constantly living beyond your means and accumulating debt?

So, how will finance training help your career? Here are just a few ways:

- You’ll be able to make smarter decisions about your money.

- You’ll be able to negotiate for a higher salary.

- You’ll be able to manage your finances better and achieve financial freedom.

- You’ll gain a better understanding of how businesses operate.

- You’ll be able to spot financial opportunities and make sound investments.

- You’ll be able to avoid financial pitfalls that can derail your career.

- You’ll be able to provide valuable financial advice to others.

- You’ll be able to build a successful career in Finance.

- You’ll be able to make an optimistic influence on the lives of others.

So, consider enrolling in a finance training course today if you need to take your profession to the next level. Finance training can help you get there regardless of your career goals. By better understanding how money works, you’ll be better equipped to make decisions that will help you achieve your goals.

What are the key Concepts Covered in this Training?

Workday Finance Training covers various topics related to financial planning and analysis, accounting, and treasury management. The key concepts covered in this Training include:

- Financial planning and analysis: This Training covers creating economic models, forecasting, and analyzing financial data.

- Accounting: This training covers double-entry bookkeeping, accrual basis accounting, and financial statement analysis.

- Treasury management: This Training covers cash, foreign exchange, and credit risk management.

What are the Prerequisites Required to learn Workday Finance?

There are no specific prerequisites required to learn Workday finance. However, basic knowledge of accounting and finance concepts is recommended.

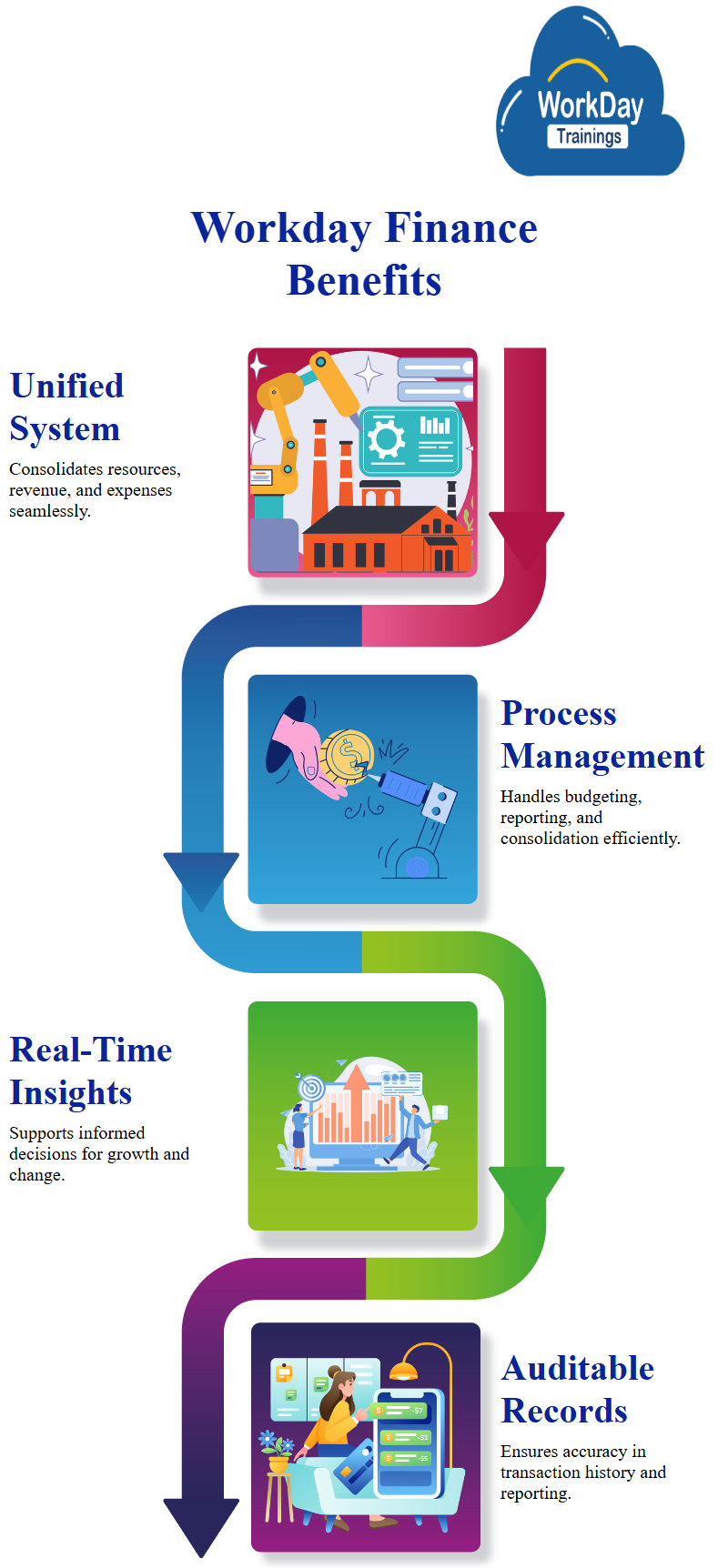

Does Training is Required to learn Workday Finance?

For me, the response is a clear yes. Learning the ins and outs of the Workday Finance Course necessitates Training, just like learning any other piece of technology.

Workdaytrainings does offer Training for Workday Finance, and it does provide several resources on its website that can be used to learn Workday Finance, including howto get the Workday Finance Tutorials, workday Finance guides, videos, and more.

This Course is complex, and there is a lot to learn to use it effectively. However, there are several ways to get Training, including online courses, instructor-led courses, and even self-study.

- Self-Paced Study:

The self-paced study is a type of learning in which students work independently at their own pace rather than following a schedule or pace set by a teacher.

- Instructor-Led Course:

Instructor-led courses are those that an instructor leads in a face-to-face setting. These courses may be offered in person or online.

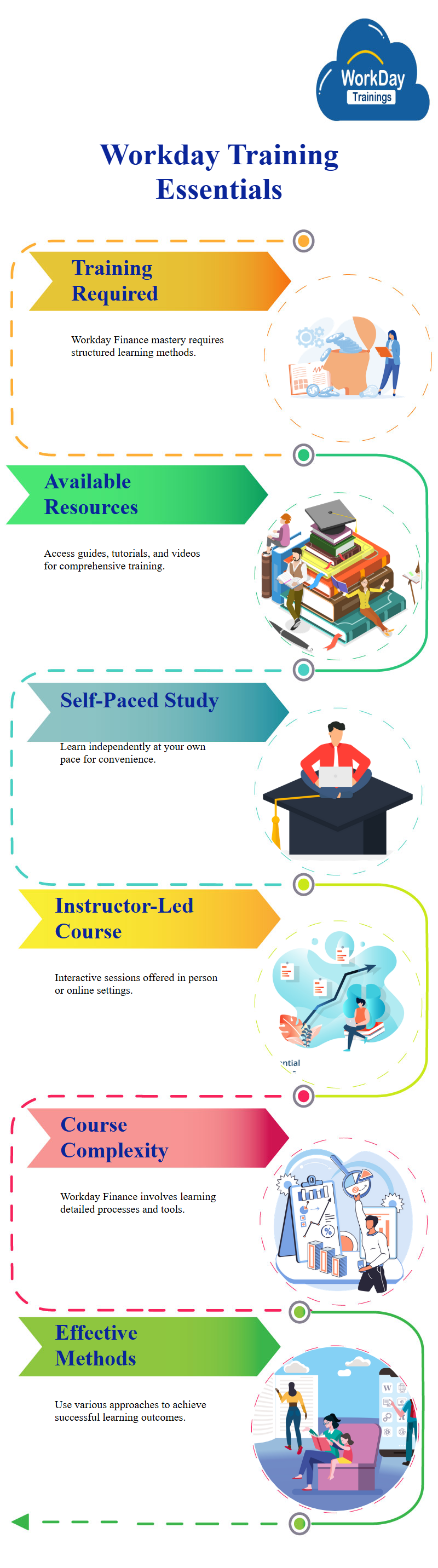

After Completing Training, how do I get Workday Finance Certification?

After completing your Training, you can get your Workday Finance Certification by passing the Workday Finance Certification Exam.

The Process of Getting Certification:

As the process of workday finance certification will vary depending on the specific finance certification program that you choose to pursue. However, workday finance certification generally involves completing a finance certification program, passing an exam, and then maintaining your certification through continued education and recertification.

How can I apply what I learn from this Workday Finance?

You can apply what you learn from this workday finance training in your work by using your acquired knowledge and skills to improve your work processes and make better decisions. This Training will help you understand workday finance concepts and principles to apply them to improve your organization’s financial performance.

Financial management is an essential skill for anyone in the workforce. Whether you are an entry-level employee or a senior executive, training can help you be more positive in your career.

There are many different aspects of financial management, from budgeting and forecasting to investment analysis and risk management. While you may not need to be an expert in these areas, it is essential to take a basic understanding of how they work.

What are some Real-World examples of topics covered in this Workday Finance Training?

Finance is critical to businesses of all sizes. Whether you are a negligible business owner or the CEO of a large corporation, you need to understand financial statements, budgeting, and financial planning. This workday finance class will cover those topics and more.

Real-world examples of topics covered in this workday finance include:

- Understanding financial statements: Financial statements are the foundation of sound business decision-making. In this Class, you will acquire how to read and interpret financial statements. You will also learn how to use financial statements to make informed business decisions.

- Budgeting and financial planning: A well-crafted budget is critical for any business. This Course teaches you how to make a budget that meets your business’s needs. You will also learn how to use financial planning tools to make knowledgeable decisions about where to allocate your resources.

- Raising capital: If you plan to grow your business, you will need to raise capital. In this Workday Finance Online Course, you will learn about the different options for raising money, including debt financing, venture capital, and equity financing. You will also learn about the advantages and disadvantages of each option.

- Managing risk: Risk is inherent in all businesses. In this Training, you will learn about different hazards and how to manage them. You will also learn about risk mitigation strategies, such as insurance and hedging.

- By the close of this training, you will have a solid empathy for running a business’s financial aspects. You can make informed decisions about anywhere to allocate your resources and how to manage risk.

Best Platform for Workday FinanceTraining:

The best Platform for Workday Finance Online Training is Workdaytrainings. I had the best experience with this platform.

The instructors are very knowledgeable andprecise in their concepts and ensure that all our doubts are cleared. The 24 X 7 technical support is constructive. The freeworkday financial demos are excellent. Overall, I had a great experience with this platform. They will also help you get the workday finance videos.

Conclusion:

We’ve reached the end of the topic. Before we wrap up, let me refresh your memory on Workday Finance.

Workday Finance is a cloud-based application that can be custom-made to meet the needs of the business. It offers a unified platform with real-time visibility into the business.

This information provides you with an overview of this technology.

I would like to know if you can assist me with any updates for my blog. Thank you very much.

I wish you all the greatest and hope you find work in a Notorious Organization.

Meet you soon in my Next Blog; in the meantime, you can read my previous articles on the Workday Trainings website.

Friends, best of luck!

Divya

Seeking Knowledge is my Ultimate Comfort, I Evolve by Learning without getting Interrupted, and I Recommend it.